SunEdison Falters; Solar Still Sunny

Air Date: Week of May 27, 2016

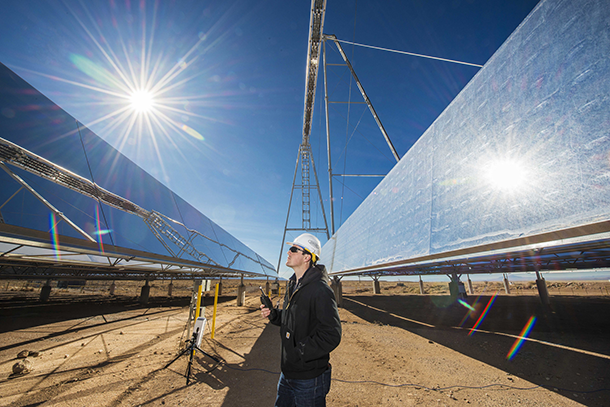

A SunEdison, Inc. engineer installs a solar panel array (Photo: IIP Photo Archive / U.S. Department of Energy, Flickr CC BY-NC 2.0)

Solar behemoth SunEdison’s Chapter 11 bankruptcy filing disappointed its investors, yet the industry as a whole is booming, says Nat Kreamer, CEO of Spruce Finance. Mr. Kreamer explains to host Steve Curwood why one company fell so far within a soaring market, and how public-private partnerships could help the growing solar industry take our energy grid to a low-carbon future.

Transcript

CURWOOD: It's Living on Earth, I'm Steve Curwood. In early May, the US reached a new milestone for solar energy: There are now one million solar installations across the country. Solar energy is booming, yet one of the biggest companies seems to be on the rocks. Solar behemoth SunEdison recently filed for Chapter 11 bankruptcy protection, and we called up Nat Kreamer, the president and CEO of Spruce Finance, to ask what went wrong. Nat, welcome to Living on Earth.

KREAMER: Thank you, thanks for having me.

CURWOOD: Nat, you know, just a year ago so, SunEdison seemed to be thriving. I understand it was the largest solar company here in the United States?

KREAMER: That's correct. SunEdison was the largest solar company in United States and was also operating globally.

CURWOOD: So what happened to the company? They’ve filed for Chapter 11 bankruptcy protection. What went wrong?

KREAMER: The fundamentals of the US solar market are incredibly strong. The truth is that SunEdison grew too fast. It fueled that growth with debt, and it didn't make enough money on what it was selling to customers.

CURWOOD: Who are SunEdison's customers?

KREAMER: Well, largely SunEdison's customers were either companies that were buying solar electricity from systems that were located at their businesses or SunEdison was developing large-scale projects in the wholesale power market, and those projects would sell their solar electricity into the wholesale power market and then utilities would buy that power.

CURWOOD: Let's break this down a little bit. Now, the wonderful thing about solar is that, once you buy the array and the associated equipment, you essentially have no fuel costs, a little bit of maintenance, but not much. That means a lot of money upfront. How did that affect SunEdison?

Nat Kreamer says that SunEdison’s financial woes were the result of its growing too quickly, and the solar industry as a whole is booming. (Photo: Randy Montoya / Sandia Labs, Flickr CC BY-NC-ND 2.0)

KREAMER: Well, you have to finance it and so, SunEdison like all companies that are financing power projects, need to use equity, meaning their own money and then either raise additional equity from new investors and/or raise debt and borrow against the future cash flows coming from that power project. If you look at what SunEdison did, is it spun off its power assets into other public companies, Terraform and Terraform Global. Those companies owned the power assets and were able to generate the cash flows from those power assets, so they were selling electrons and were able to raise equity and raise debt. Those two companies are actually doing well. They're providing a return to their investors and their operating the market.

SunEdison, when it sold off those assets and basically spun them out to other investors was left with the development business, and that development business was looking for projects of sort of selling projects if you well, and it was holding a lot of debt at the same time, and if you take on too much debt just like an average person taking on too much debt, eventually you run out of money and you go bankrupt. That has not been true for many, many other solar companies in the United States, and in fact that industry at large is quite healthy and has been growing in the double digits. You see many successful solar companies, especially ones that are publicly traded like SunPower or FirstSolar, who have operated consistently and profitably during the same period of time.

CURWOOD: People listening to us might think, “Hey, this sounds like the Solyndra problem of five years ago”. What makes this bankruptcy different?

KREAMER: What's really entirely different is Solyndra attempted to create a new type of solar technology that it believed would be lower cost than the type of solar technology that is generally used by the industry today and that most Americans are familiar with because they've probably owned a solar power calculator at some point in their life. Solyndra bet that its technology would drive down cost faster than the cost fell for the fundamental technology that we use, and Solyndra was wrong. But that didn't really have any bearing on what happened in general with US solar industry. In fact, solar became more competitive and because it became more competitive and created more value for end customers and for the American public at large Solyndra didn't have a business. What happened here is that SunEdison used that proven technology that had become lower cost and started investing in a lot of systems. They just grew way faster than their organic capital could support, and they borrowed too much money, and so it's really a story of overleverage as opposed to a bad technology bet.

As photovoltaic panel technology has improved over the last few years, solar energy costs have dropped dramatically. (Photo: Michael Mazengarb, Flickr CC BY-NC 2.0)

CURWOOD: Let's talk generally about the solar business. How do we deal with the fact that there's many utilities that have become somewhat reluctant to accept small-scale residential solar on the grid?

KREAMER: So, as the CEO of Spruce Finance, our corporate equity investors include five of the ten largest utilities in the United States. And what that tells you, because we're in the business of providing financing to consumers to put residential solar systems on the roof, is there are many of the leading utilities that see residential solar as a fantastic growth opportunity and have invested in the company that I run. There are some utilities in United States, notably in California and now in New York, where the utility is compensated for running the grid and, in fact, they have an incentive to get more people to use their grid, so they're excited about more distributed solar. They're excited about electric cars and charging stations and storage. There are other utilities who view residential solar, or distributed solar more generally, as a threat to their business model. It's because they view it as a competition for being able to sell the end customer electrons. So either the utility is going to sell you the electricity or a distributed solar company is going to sell the electricity. And so the utility in some instances in some markets have tried to take actions to basically slow down or stop the market for distributed solar.

CURWOOD: Nat, to what extent is some of the utility opposition a stalking horse for the fossil fuel industry?

KREAMER: Well, there's definitely an entrenched interest. If you look at what's happened in the United States, natural gas, solar, and wind are being developed more and more. Coal is being used less and less, so you're seeing investors and owners of coal and coal-fired power plants have a smaller customer base and see their market eroded, and naturally they look at the natural gas industry and the solar industry and the wind industry, and say, “Those companies are taking my revenues.”

CURWOOD: What needs to happen to deploy solar energy at the rates that we need here in United States?

Nat Kreamer is the President and CEO of Spruce Finance, a solar energy financing company. (Photo: Spruce Finance)

KREAMER: Well, we have great fundamental long-term federal policy that is going to support the investment in solar to keep driving down the cost of solar so that it becomes attractive in more and more states in the United States. We have fundamentally a strong financing industry in the capital markets to finance the investment in solar projects. We have great technology and innovation both in terms of a Department of Energy research, fundamental research for long-term growth, as well as for corporate research which is innovating every day. Where we find challenge is local policy that's happening at the state level. In some markets you have a utility whose...the way to get compensated gives them an incentive to bring more renewable energy, specifically solar, onto their grid. In other markets the way to get compensated gives them an incentive to resist getting more solar energy, and so we need to resolve that conversation so that we are able to deploy more residential, commercial, and utility scale solar in the United States.

CURWOOD: Nat Kreamer is the President and CEO of Spruce Finance and Chairman of the Board of Directors of the National Solar Energy Industries Association. Nat, thanks so much for taking the time with us today.

KREAMER: Thank you all for taking the interest.

Links

The Wall Street Journal: “SunEdison Files for Chapter 11 Bankruptcy Protection”

The Wall Street Journal: “Inside the Fall of SunEdison, Once a Darling of the Clean-Energy World”

Living on Earth wants to hear from you!

Living on Earth

62 Calef Highway, Suite 212

Lee, NH 03861

Telephone: 617-287-4121

E-mail: comments@loe.org

Newsletter [Click here]

Donate to Living on Earth!

Living on Earth is an independent media program and relies entirely on contributions from listeners and institutions supporting public service. Please donate now to preserve an independent environmental voice.

NewsletterLiving on Earth offers a weekly delivery of the show's rundown to your mailbox. Sign up for our newsletter today!

Sailors For The Sea: Be the change you want to sea.

Sailors For The Sea: Be the change you want to sea.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth