A Carbon Dividend Plan

Air Date: Week of February 10, 2017

The carbon tax dividend Halstead and his colleagues are proposing would initially raise the price of a gallon of gas by 36 cents, at a price of $40/ton of carbon dioxide, but rebate it all to consumers. (Photo: Mike Mozart, Flickr CC BY 2.0)

Conservatives could support a carbon tax if it also reduced EPA regulations and made payments to consumers to offset the costs, say advocates led by Republican elder statesmen, including former Secretary of State James Baker. They have proposed an ambitious Carbon Dividend plan that could entice bipartisan support, pay families $2000 a month, and cut greenhouse gas emissions more than Obama’s Clean Power Plan. Co-author Ted Halstead of the Climate Leadership Council explains its appeal and mechanics to host Steve Curwood.

Transcript

CURWOOD: From PRI and the Jennifer and Ted Stanley Studios at the University of Massachusetts Boston, this is Living on Earth. I’m Steve Curwood. Capitol Hill action on global warming has been stalled for years, but that could change thanks to a plan being advanced by Republican senior statesman, James Baker.

BAKER: There’s a carbon tax buried in there somewhere, but this is a program on carbon dividends. Make sure you understand that. And every American is going to get a dividend quarterly, from the taxes that are collected on the production of carbon.

CURWOOD: The former secretary of both state and treasury is leading the launch of this new plan to reign in carbon emissions. It’s called “The Conservative Case for Carbon Dividends.” The title aims to entice tax-averse GOP legislators to sign on. Ted Halstead, founder and President of the Climate Leadership Council, is a co-author of this daring new blueprint, and HE joins me now. Welcome to Living on Earth.

HALSTEAD: Nice to be with you, Steve.

CURWOOD: So, Ted, why hook up with really senior powerful Republicans for this vision of how to move forward on the climate?

HALSTEAD: Because the main impediment to solving climate change at the necessary scale and speed is one party in one country. The major breakthrough that is needed is getting the Republican party on board for a climate solution that fits the conservative world view, and it's been a profound honor to work with such distinguished figures as George Schultz, Jim Baker, Hank Paulson, Marty Feldstein, and Greg Mankiw. So, we have three former Republican secretaries of treasury, two former Republican secretaries of state, and two former Republican chairs of the Council of Economic Advisers. We also are fortunate to have Rob Walton as a co-author who is the former chairman of Walmart, of course, the world's largest private employer.

CURWOOD: Ted, for years, former South Carolina Congressman Bob Inglis has been calling for a carbon tax. What exactly does your plan call for?

“The Conservative Case for Carbon Dividends” was produced by a collaboration that includes senior Republican leaders. (Photo: Climate Leadership Council)

HALSTEAD: A carbon tax is part of what we are proposing, but our plan is called “carbon dividends,” and it's a very different beast. I mean, simply put, an economist would tell you that a carbon tax is the most efficient way to solve climate change. The problem is that proponents of that position have long lacked a coherent political strategy to move forward on that issue because, by itself, a carbon tax is deeply unpopular. So, what we're proposing is a carbon tax with 100 percent of the proceeds going back to the American people in the form of dividends. Now, that's just one of the arguments in favor of it. For Republicans, the arguments that I think will be equally powerful is that this is a pro-growth plan. This is a pro-competitiveness plan. This is a plan to reduce regulation and shrink the government, all the while saving our climate. So, it's a new synthesis, but it is built on bedrock Republican principles.

CURWOOD: Alright. Now, let's walk through the four basic elements of your plan. At the top of the list, and the title that you use for this, is a dividend from carbon. In other words, a typical family of four would receive about $2,000 a year. So, this dividend means that any tax, if I understand correctly, would be essentially for the economy - neutral. There will be no growth in government. There would be no drag on growth in the conventional economy this way.

HALSTEAD: That's correct. It would be revenue neutral; however, just to clarify, every American would get a dividend, and every American would get the same dividend whether you're rich or you're poor. But what the Treasury Department found in studying this is that for the bottom 70 percent of Americans, they would come out ahead, meaning they would receive more in dividends than the added cost for carbon. That means 223 million Americans stand to benefit from this new solution to climate change. So, it's a real populist climate solution that fits our political moment.

CURWOOD: How is the public going to embrace this when the first thing they're going to see is the higher price of gasoline, more money at the pump?

HALSTEAD: Well, first of all, we’ll probably make the dividend monthly, so people would get it monthly, and we may even try to pay it in advance the first month so that there is none of that problem. In order words, the dividend comes first, and increased payments come second. But again, the key point: The bottom 20 percent of Americans, 223 million Americans, would come out ahead.

Ted Halstead says the carbon dividends plan would cut twice as many greenhouse gas emissions as former President Obama’s Clean Power Plan. Above, Obama stands at the bow of a ship on a 2015 tour of Alaska that highlighted the impacts of climate change. (Photo: Pete Souza / White House, public domain)

CURWOOD: So, let's talk about the tax. You say it would begin at the level at $40 for each ton of carbon dioxide associated with the emissions, and then it would ratchet up. How high could it go?

HALSTEAD: Well, you know, $40 per ton is near the high end of what is politically feasible in Washington today. That's about $.36 cents per gallon extra at the pump. When you ask of what is ultimately needed, it's a much higher number, if you work backwards from the goal of keeping climate change or warming, rather, at the limit of 2 degrees Centigrade that all scientists and all world leaders who attended the Paris conference recently agreed to. So, if that's the goal, we need to reduce CO2 emissions in America by about 70 percent by mid-century, and in order to accomplish that, you need a tax that's at $100 per ton or more. But that's not the starting point. You need to get people comfortable with this. In our paper, we said after five years, a Blue Ribbon commission should analyze whether to continue growing, based on the latest climate data. So, there is a built-in checkpoint after five years.

CURWOOD: Now, your third pillar of this, you call border carbon adjustments, that is, that people say manufacturing goods or producing something in another country that doesn't have carbon constraints might be able to, in the words of an economist, dump their carbon heavy products in the US and undercut local production which is subject to the tax. But what about the other way around? What disincentives are there for American companies to go and get carbon intensive fuels such as coal and export it, where it'll get burned in countries that it may not have any regulation of carbon?

HALSTEAD: So, if companies are doing that now there would be no change in incentives for them. What we're trying to do is improve on what we have now, and what is not widely understood is that the current global economic rules of the game actually subsidize dirty producers abroad. So, you know, President Trump is particularly concerned about the way in which our environmental regulations could hurt American companies and jobs and so forth. Well, the best answer to trading with partners that have weaker environmental standards is not to lower our standards. It's to penalize them for theirs, and that is exactly what our border carbon adjustment would do. So, if we're trading with a company that has lower carbon prices than the ones that we put in place, we would tax them at the border for the difference. By contrast, because we, of course, don't want to harm our own companies, if our country's export to a nation that has lower environmental cost, they would get a rebate for any carbon tax that they've paid.

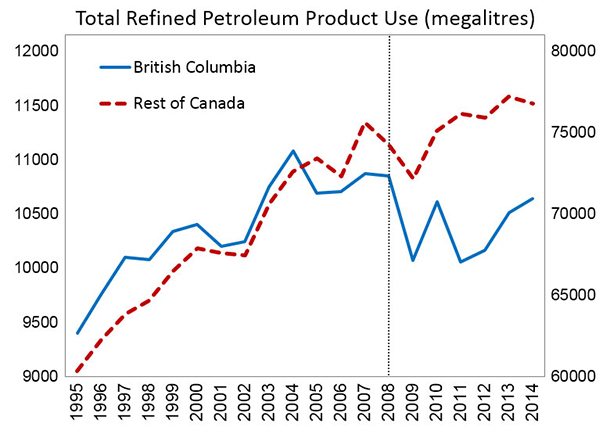

British Columbia’s carbon emissions have gone down since a carbon tax was implemented there in 2008, as compared to the rest of Canada. (Photo: Lawrencekhoo,Wikimedia Commons CC0 1.0)

CURWOOD: But what are the disincentives for American companies to go, say, mine coal out of the Powder River Basin and export it to the world. Any carbon dioxide molecule anywhere in the world is contributing to global warming whether it's emitted in the US or in China or India or, you know, some Third World country that has virtually no limits on carbon emissions.

HALSTEAD: So, Steve, that's an insightful question, and you are correct that our system would not provide a disincentive for that. But, I would point out that that would be no change from where we are today. What would change, though, is that, by putting in place a system of border carbon adjustments, it would very soon compel other countries to set up their own carbon pricing at similar levels to ours, and then -- Guess what -- any coal mined in the United States and exported would be subject to the exact same taxes, and of the various fossil fuels everybody knows that coal is the most carbon intensive. So, coal will be hit very hard by our plan, but even there there's an elegant way out. It turns out that at a carbon price of between $50 to $100 per ton, it becomes economical for utilities to invest in carbon capture technologies at the coal plants. So, what we end up with is not the end of the coal industry as some fear, but rather, clean coal.

CURWOOD: The fourth major pillar of your proposal is to roll back lots of regulations and course, in particular, there's the question of President Obama's Clean Power Plan. Tell me how your carbon tax and dividend proposal compares to the Clean Power Plan, in terms of carbon emissions averted and rules that you think could be removed.

HALSTEAD: Sure, when we put out our statement, we put out a corresponding analysis by two of the top scholars in the field and what it found is quite stunning. It compared our plan to all Obama-era climate regulations, including a full implementation of the Clean Power Plan, and what the study found is that our plan would achieve nearly twice the emission reductions of all the Obama-era policies combined. What's more, the study also found that with our plan and our plan alone, America could meet the high end of its Paris commitment with no other policies. So, the logic here is that if you have a powerful enough, market-based policy, you don't need the regulations any more. Obviously, it's a difficult pill for a Democrat, an environmentalist to swallow the elimination of regulations, but frankly that is what motivates the Republicans, and that is where we can have a major breakthrough here.

CURWOOD: How likely is your plan to succeed in this Republican-controlled Congress, especially among those members of Congress from coal, oil and gas producing states?

HALSTEAD: Well, Steve, you know, there is this mischaracterization of the Republican position on climate change that boils down to confusion between means and ends. Most Republicans, like most Democrats, want a healthy climate for their children and want to protect our climate. The entirety of the debate, or almost all of it, is about the means of getting there, and the reason why Republicans have constantly been opposing the Democratic plans is because they hate regulation, and they see heavy-handed regulation as growth inhibiting and as bad for the competitiveness of US firms. OK, but now Republicans are finally in charge, right? So, because they're in charge, there's no more threat of these regulations. So, now there's an opportunity.

Ted Halstead, Secretary James Baker, Martin Feldstein and Gregory Mankiw met with White House officials on Wednesday, February 8th to discuss their “conservative case for carbon dividends”. (Photo: Юкатан, Wikimedia Commons public domain)

CURWOOD: Well, but, wait a second, Ted. I think you have to point out that many, many Republicans, especially leaders, have delegitimized the whole question of climate change. Years ago, for example, John McCain and Speaker Gingrich signed on to climate action, but since the cap-and-trade legislation failed, the mantra in the Republican Party has been around scientific skepticism, or, if there's a problem, how much of it is man-made. It's not been a willingness to go forward on this. It’s been really denial, I think, especially on the part of leadership.

HALSTEAD: Look, you know, we can spend lots of time debating this. I think there's a much more interesting point of where we can go in the future, but on this point, Steve, if you listen carefully to what the cabinet appointees said on this topic in their nomination hearings – And, granted, this is about as anti-climate a cabinet as you can imagine, in general, especially the EPA Administrator -- But they all said, “Climate change is real”. They say, “Well, we're not sure how much, you know, it's man made,” but they said it's real. And then they go on to say, “But we're worried that any solution would undermine the competitiveness of US firms and would be bad for the economy.” So, the big turning point here is that we have a plan that is good for the economy, that's good for the competitiveness of US firms.

Republicans are going to have a major PR problem on their hands when they start dismantling all of the climate regulations. If they follow a repeal-only strategy, that is going to be highly unpopular, and it is going to cost them in the same way that a repeal-only strategy on health care is just not politically viable. It's political suicide, in fact. So, sooner or later they, are going to come around to a solution. Our goal in launching this was to say, “Here is the conservative solution”. To put it in tech-speak, it is the “killer app” of climate policy because it accomplishes all of these goals at once. It solves the climate problem better than the Democratic policies, but it's also, it ticks every box that Trump cares about. It is pro-growth, pro-competition. It is deregulatory. It is pro-jobs. It rebalances trade, and, most of all, it is good for working-class Americans. So, it ticks all their boxes.

Ted Halstead is the founder, President and CEO of the Climate Leadership Council. (Photo: Climate Leadership Council)

CURWOOD: Ted, before you go, tell me, why does your plan include a proposal to give companies immunity from lawsuits for polluting the atmosphere with greenhouse gases?

HALSTEAD: What we're trying to find here is a package of policies that both sides can live with. So, you need to offer the Republican Party deregulation, and also there is no upside in fighting it out with historic polluters if you have a new plan that dramatically and consistently reduces emissions over time. That is the goal. Let's keep our eyes focused on the goal. It is to solve the climate problem at the required scale and speed. If we have a solution that does that, well then, why not let the companies not have any more legal liability on carbon emissions? By the way, we're not talking about the other greenhouse gases because our policy right now doesn't touch those. But on carbon emissions, if we’re going to price it, well then we shouldn't be litigating it at the same time. It's just sensible politics, right, because the policy works, and if you believe the policy works then you don't need these other sticks at the same time. So, it's all part of finding a compromise that all sides can live with.

CURWOOD: Ted Halstead is Founder, President and CEO of the Climate Leadership Council in Washington. Ted, thanks for taking the time with us today.

HALSTEAD: Thank you, Steve. Much appreciated.

Links

“The Conservative Case for Carbon Dividends”

NYTimes Op-ed by Martin S. Feldstein, Ted Halstead, and N. Gregory Mankiw,

Living on Earth wants to hear from you!

Living on Earth

62 Calef Highway, Suite 212

Lee, NH 03861

Telephone: 617-287-4121

E-mail: comments@loe.org

Newsletter [Click here]

Donate to Living on Earth!

Living on Earth is an independent media program and relies entirely on contributions from listeners and institutions supporting public service. Please donate now to preserve an independent environmental voice.

NewsletterLiving on Earth offers a weekly delivery of the show's rundown to your mailbox. Sign up for our newsletter today!

Sailors For The Sea: Be the change you want to sea.

Sailors For The Sea: Be the change you want to sea.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth