Cleaning Up Crypto

Air Date: Week of November 25, 2022

Most cryptocurrencies like Bitcoin still use an energy-intensive mechanism known as proof of work. In September 2022 the rival cryptocurrency Ethereum switched from proof of work to proof of stake, which vastly reduces the amount of computational work and therefore energy involved in earning new coins. (Photos: Bitcoin: Komers Real, Flickr CC BY 2.0. Ethereum: Quote Catalog, Flickr CC BY 2.0)

Cryptocurrencies like Bitcoin can take a huge toll on electricity rates and the climate. That’s because “mining” cryptocurrencies typically involves massive amounts of computation, which takes lots of energy that’s mostly sourced from burning fossil fuels. But now there’s a far more efficient way to earn new coins if cryptocurrency managers decide to adopt it. Alex deVries is the founder of Digiconomist and a PhD candidate in Economics at Vrije University in Amsterdam and joins Living on Earth’s Jenni Doering to discuss.

Transcript

CURWOOD: Many of us still don’t quite understand how cryptocurrencies like Bitcoin work, and the sometimes devastating impact they can have on electricity rates and the climate. So, let’s pull back the curtain. Instead of currency issued by a government central bank, cryptocurrencies are like the promissory notes that local banks used to issue back in the early days of the United States. These bank notes could be traded, although bank failure could make them worthless, so people generally preferred gold and silver coins. Cryptocurrencies are modern-day versions of such private money. But instead of printing notes, crypto relies on ledgers kept on computers linked in blockchains, so records of transactions can’t be altered. Bitcoin is the most popular cryptocurrency and creators of blockchains needed to verify Bitcoin transactions are paid in Bitcoin. That process is called mining and it requires that computers solve complicated mathematical puzzles. And at any given moment the fleet of computers mining bitcoin uses more electricity than the entire nation of Austria, much of it from fossil fuels. So, there is climate risk as well as investment risk. But the climate risk doesn’t have to be that way. For more we called up Alex de Vries, the Founder of Digiconomist and a PhD candidate in Economics at Vrije Universiteit Amsterdam. He spoke with Living on Earth’s Jenni Doering.

DOERING: So what is it about cryptocurrency mining that requires so much energy? Can you kind of put this into context for us?

DEVRIES: Currencies like Bitcoin, they're open systems and theoretically anyone can help with processing new blocks of transactions for the underlying blockchain systems. In order to make these new blocks for the Bitcoin blockchain and any other mining based blockchain, you have to participate in what is effectively a massive game of guess the number, where your machine is just going through a process of trial and error trying to find a lucky number. And only when the machine succeeds, then you get to create the next block for the blockchain. That guessing process is where all the energy consumption is because the Bitcoin network by itself is now generating 200 quintillion guesses every second of the day non stop. That's 200 with 18 zeros. It’s an unimaginably large number.

DOERING: Wait, every second 200 quintillion?

DEVRIES: Yes, 200 quintillion. It's just trial and error, so everything that is wrong is immediately discarded. And again, they get it right only once every 10 minutes, despite all those attempts. And the reason why they do it is of course, they get a reward for it, because every block they create comes with its own reward. At the moment, 6.25 Bitcoins, which is of course a substantial amount of money.

DOERING: And of course, it matters where that energy is coming from, how it is being generated. Do we have a sense of how much of the energy that cryptocurrency mining is using is generated from clean sources of electricity versus dirtier sources of fossil fuel based power?

DEVRIES: So we can quantify that based on their current locations, the amount of renewables in their energy mix is probably just 25%. And the situation might even be worse than that because if you consider what actually happens when these miners take place in, for example, a state like Texas, in most situations on most grids, renewables actually come first in the merit order, which means that renewables are running and we use fossil fuels as a backup. If you increase demand on those grades, you're actually just adding more demand for fossil fuels, you're not adding more demand for renewable energy.

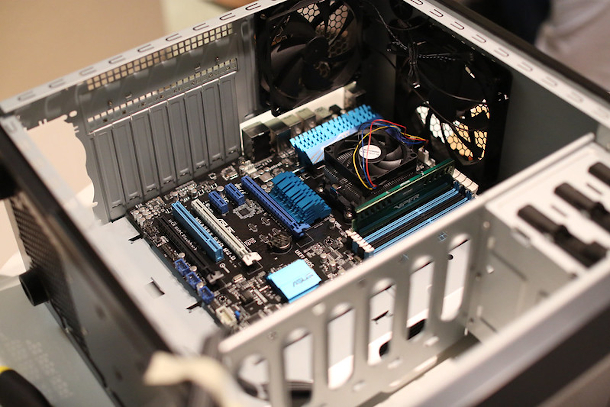

Traditional cryptocurrency mining to produce new Bitcoins and other currencies demands massive amounts of computational power. Most mining operations are comprised of networks of highly efficient computers working in tandem. (Photo: Brendan Lim, Flickr, CC BY-NC-ND 2.0)

DOERING: Yeah. A form of incentive that we do see over time with technologies as they develop is this drive towards efficiency. I'm wondering to what extent that's happened with cryptocurrency mining?

DEVRIES: Well, there are indeed efficiency improvements in the mining devices. But contrary to other industries, it doesn't mean that the energy consumption of the network goes down. I previously showed that the computational power of these machines is more than doubling per unit of energy every one and a half years on average. So, the improvement rate of the newly available devices is very, very high. The unfortunate thing is that in crypto mining, if these miners can afford to spend five billion per year on electricity, it doesn't really matter what device they have, you know, if you give them a more efficient device, they'll get two of that device instead of one.

DOERING: Yeah. China did ban the practice of cryptocurrency mining. That was back in 2021. They used to be the leading crypto mining country. Why did the government ban mining and how has that changed things in the industry worldwide?

DEVRIES: Well, they were the first to actually cite environmental reasons as a reason for kicking these miners out because there was a ruling that mining contracts are illegal in the face of the country's climate goals. They were previously hosting more than half of the Bitcoin network. According to data provided by Cambridge, we see that miners relocated from China to Kazakhstan and several states in the US like Texas, Georgia and Kentucky. Unfortunately, these miners, which were previously using relatively many renewables in China, when they moved to the US and when they moved to Kazakhstan, they actually lost a lot of access to renewables. Because in Kazakhstan the energy mix is almost entirely made up of coal. But even in the US, the states that I mentioned are strongly dependent on fossil fuels as well.

DOERING: You know, as cryptocurrency mining has shifted from China to other places, including the United States, there has been a real concern about that driving up electricity bills for local residents and businesses. I understand that there was a study by researchers at the University of California Berkeley that looked at upstate New York and they found that crypto mining pushed up bills for local residents by six percent. How can we ensure that cryptocurrency growth doesn't push up electricity prices for everyday citizens?

DEVRIES: Well, if you want to ensure that you shouldn't be allowing them on your grid. The thing is, if you are dealing with a limited energy supply, which is the situation on most grid, we don't have unlimited energy available, then obviously, if we're going to be giving part of that energy away to these miners and in some places like Texas, these miners have gotten really ridiculous contracts, like Ria Blockchain in Texas got a fixed rate contract up until the year 2030 and they're only paying two and a half cents per kilowatt hour. Well, I think locals are already playing around 20 cents per kilowatt hour, and the prices are still going up. If you enter into these contracts you're going to be reducing the available capacity for the rest of the grid and then it becomes a really simple situation of supply and demand. So yeah, of course, prices are going to go up. And of course, also related to that, fossil fuel use is also going to go up simply because we need to trigger our backup fossil fuel sources to be supplying them. And what do you get back from that? Well, a facility that provides really a low amount of jobs compared to the amount of power that it's using.

The bitcoin mining boom in Texas means the state is facing massive costs to shore up its shaky power grid, and consumers may be left with the bill https://t.co/iIHiTXMw0J

— Bloomberg Crypto (@crypto) March 15, 2022

DOERING: I believe in upstate New York, there was actually a cryptocurrency mining company that bought an old coal plant that was, you know, sitting idle and decided to restart it. What exactly happened there?

DEVRIES: Yeah, I mean, these miners are looking for cheap and constant power. If you have an obsolete gas plant, that is actually a very ideal target for this type of operation. What we saw is that in this case, the plant was a former coal plant, it was sitting idle and ended up being repurposed as a gas plant mainly for powering this new mining operation, which by the way, triggered a lot of resistance from the locals, to the extent that New York has very recently passed a new law to prohibit this from happening again. This exact scenario I think is an important signal because this industry typically claims that they are not just using renewables but actively boosting the use of renewables, which is a ridiculous claim, considering what's actually going on on the ground.

DOERING: So we've been talking a lot about Bitcoin, which is the most popular cryptocurrency. But there's also Ethereum, and I think it's around number two. And they recently made a really big switch in their operations, which may actually improve the efficiency. Can you explain what this switch was and what impact it's had?

DEVRIES: Yes, indeed. So previously, Ethereum was a massive contributor to the overall footprint of crypto assets in general. Their environmental impact was about half of what Bitcoin network's impact was so they were a pretty significant force to be reckoned with. What they changed is they got rid of the energy intensive proof of work mining process and they replaced it with a more environmentally friendly alternative known as proof of stake. And what that basically does, it changes the way in which new blocks are being created for the blockchain. So I talked about how in proof of work, you need to have very powerful energy hungry machines in order to be able to make new blocks for the blockchain and then the more machines you have, the bigger your chance of winning the lottery that will allow you to make the next block for the blockchain. In proof of stake, there is still a lottery but it works completely different. In fact, you have to acquire some Ether, 32 Ether at minimum, and then you put those coins as collateral in the staking process. And then the software will randomly select one of the stakers to create the next block for the blockchain. And that sounds a lot less energy intensive because it doesn't involve those energy hungry machines. You do still need a device with an active internet connection but how powerful the device does not matter. In fact, the only way to increase your odds in that system is by just accumulating more wealth, increasing your stake. So it kind of does away with the whole incentive to just consume more energy, get this really highly specialized and energy hungry equipment. And we can estimate that as a result of this change, the network probably reduced its energy consumption somewhere between 99.84% to 99.9996%. Which is, of course, a tremendous reduction, given that they were, you know, previously consuming as much power as a country like Austria by themselves.

DOERING: Wow, that's a huge reduction. So we're talking about maybe 1% or less of the energy consumption that it used to involve?

DEVRIES: Yeah, not even one percent, maybe not even 0.1%.

DOERING: Wow. So what kind of interest is there in the Bitcoin world or from other cryptocurrencies about making a similar switch?

DEVRIES: That's very interesting question because we know that in Bitcoin’s case if you were to even try to suggest this in the community they will just laugh at you and say it will never happen, and that's it. They don't have any motivation whatsoever to make this change. In fact, they have a bit of a history being very anti change, various upgrades that were proposing the past–In other communities, it will depend on which community you ask and how they might be more open to do something similar. But it really depends on the community. This is more of a social thing than it is a technical thing. You can replicate the success of Ethereum in making the switch happen in any live crypto asset. It can be done in Bitcoin, it can be done in any other crypto coin that is currently still running on the energy in terms of proof of work. But you need to have a community that is sufficiently willing to actually go ahead with it and that's where things get tricky.

Alex de Vries is a data consultant and the founder of Digiconomist.net. (Photo: Alex de Vries)

DOERING: So at a time when energy costs are, in some places, are sky high, what role can governments play in reducing the carbon intensity of cryptocurrencies and reducing these energy demands that they put on entire grids?

DEVRIES: That is the tricky thing with Bitcoin mining, it is completely location independent. It doesn't matter where you put your mining machine, you can put it anywhere in the world. So if you kick them out of one location they'll just go to the next bad location. And I think that if a regulator wants to seriously do something about this industry, they should probably target the investors first. I mean, ultimately the environmental impact of these assets are closely related to the value of the asset. And if the price is zero, there is no environmental impact because miners don't make money. And as everyone just keeps getting into Bitcoin, which many large corporations actually pushing investments into Bitcoin, have to realize they're also facilitating an increase in value of Bitcoin, which ultimately reverberates environmentally, through the miners that are profiting from that as well. So from a policy maker perspective you can think about like, okay, environmental disclosure, make investors aware of what is going on behind the scenes,.We’re seeing this now in Europe, where disclosure is becoming mandatory for any crypto asset service provider to provide more information about the investments that they offer. But you could go a step further, how you could start working with environmental taxes to discourage investments in these assets, which would supposedly drive down the price. If you're discouraging people to invest, then you're going to drive down the price and in turn the environmental impact.

CURWOOD: That’s Alex de Vries, Founder of Digiconomist and a PhD candidate in Economics at Vrije Universiteit Amsterdam, with Living on Earth’s Jenni Doering.

Links

Digiconomist Bitcoin Energy Consumption Index

Digiconomist Ethereum Energy Consumption Index

Bloomberg | “Crypto Mania in Texas Risks New Costs and Strains on Shaky Grid”

Living on Earth wants to hear from you!

Living on Earth

62 Calef Highway, Suite 212

Lee, NH 03861

Telephone: 617-287-4121

E-mail: comments@loe.org

Newsletter [Click here]

Donate to Living on Earth!

Living on Earth is an independent media program and relies entirely on contributions from listeners and institutions supporting public service. Please donate now to preserve an independent environmental voice.

NewsletterLiving on Earth offers a weekly delivery of the show's rundown to your mailbox. Sign up for our newsletter today!

Sailors For The Sea: Be the change you want to sea.

Sailors For The Sea: Be the change you want to sea.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth