Insurance and Homeowners Underwater

Air Date: Week of September 19, 2025

Florida is battling an increasing number of extreme storms because of climate disruption. The above photo shows damage in Keaton Beach, Florida following Hurricanes Helene and Milton. (Photo: Staff Sgt. Jacob Hancock, U.S. Air National Guard Flickr, CC BY 2.0)

While the 2025 Atlantic hurricane season has been relatively quiet, last year damages from three major hurricanes ran to over 200 billion dollars and claims have stressed homeowners and insurance companies alike. Inside Climate News journalist Amy Green shares with Host Steve Curwood what she learned from Florida homeowners facing rising premiums and the cancellation of their insurance policies.

Transcript

DOERING: It’s Living on Earth, I’m Jenni Doering.

CURWOOD: And I’m Steve Curwood.

So far this year the Atlantic hurricane season has been relatively quiet, but last year damages from three major hurricanes ran to over 200 billion dollars and claims have stressed homeowners and insurance companies alike. It’s become a crisis in the sunshine state, where Florida homeowner Amy Green writes for our media partner Inside Climate News. She says there are added pressures on low- and middle-income folks who need insurance to meet the covenants of their mortgages. Amy Green joins me now on the line from Orlando. Welcome back to Living on Earth, Amy!

GREEN: It's great to be here. Thank you.

CURWOOD: Now, Amy, talk to me about this story that you wrote for Inside Climate News, where in the title you refer to Florida's home insurance crisis. How does one explain this crisis to someone unfamiliar with the situation?

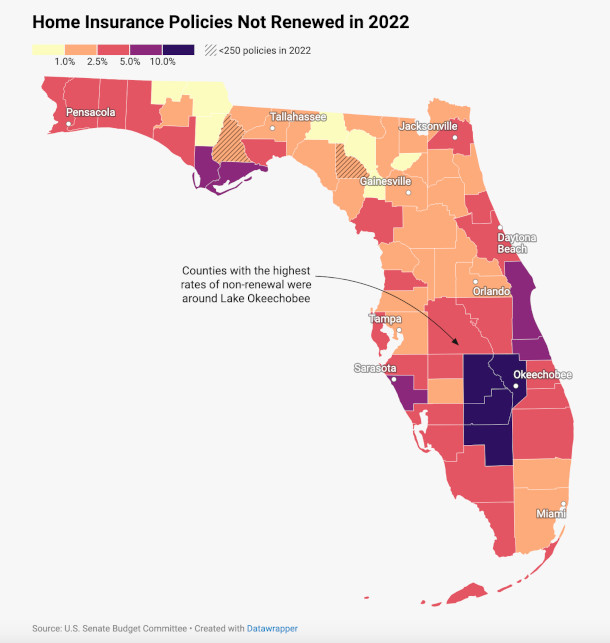

GREEN: So I would say that in Florida, we kind of have two main problems when it comes to insurance. The main problem our story addressed was a situation where escalating climate risk is driving insurance companies to withdraw policies from homeowners altogether, and Floridians are receiving insurance non-renewal letters, cancelation letters, from their insurance companies. And Inside Climate News, we did an analysis that found that while this is a problem all across the country, especially in kind of climate risk hot spots like Louisiana and California, Florida, as you said, is kind of ground zero for this problem because of the hurricanes we get in our state. And our analysis found that the problem is especially acute, not in the coastal areas where you might expect but in the agricultural communities in the heartland of our state.

CURWOOD: Wait a second, now we think of the storms coming ashore and the storm surge and everything, but you're saying it's the center of the state, closer to the middle, that's more of a problem? How is that?

GREEN: We were very surprised. Our analysis found that in counties like this, counties where climate risk is combined with poverty and other socioeconomic factors that make it harder for communities to recover from disasters, these are communities where insurance non-renewal rates are some of the highest.

CURWOOD: So in other words, if you're poor, you're going to pay more for insurance or lose it, than if you're rich, even though you're not along the coast where you would expect these storms to come ashore.

Despite being an inland community, rather than a coastal one, residents of Okeechobee County and its other neighboring rural counties have been seeing greater rates of insurance policy non-renewals. (Image: Data from the U.S. Senate Budget Committee, Graphic created with Datawrapper, Courtesy of Inside Climate News)

GREEN: Well, our analysis focused on insurance non-renewals, but you brought up kind of the other side of the coin when it comes to insurance problems in Florida, which is the exorbitant cost. The cost of insurance in Florida is jumping by leaps and bounds. And while that was not the problem that our analysis really focused on, it was one that we couldn't help but touch on in our project, because it was such an important problem. When I visited one of these counties, Okeechobee County, on the north side of Lake Okeechobee, the state's largest lake, I talked with people who were receiving renewal letters from their insurance companies for $12,000, $16,000 a year, and these are in communities where the median income is $40,000, $50,000, $60,000 a year. So these are really exorbitant insurance costs. And so what you have is a situation where the people who have the least resources for dealing with disasters are really the ones who are most vulnerable to losing insurance, either because their insurance companies cancel their policies or because they just can't afford it, and if they have their mortgage paid off, more and more of these people are going without insurance altogether, and that just leaves these communities even more vulnerable to the next disaster.

CURWOOD: Indeed. So Amy, not only are insurance companies raising rates, but they're pulling out of markets entirely. I mean, it's just got to be really difficult for homeowners confronted with that.

GREEN: It's a major problem. For most homeowners with a mortgage, the mortgage companies require homeowners to have insurance, and so where people can get insurance, in these communities where insurance is hard to get, a lot of these people will pay whatever is asked of them because they're just happy to have an insurance policy. So it's a major economic concern for these communities, because paying more on insurance means, you know, having less money to go out for dinner or buy a new car, and that can affect other businesses in the communities. I talked with residents who had family members who were working two jobs or they were working overtime. One woman had a family member who was a firefighter and he was working overtime to pay for a $16,000 a year insurance policy. And I even found that when I visited Okeechobee County, insurance, it's supposed to be something that you pay for, and you forget about it, but it's there if you need it. But I found that in these communities, people think about insurance a lot, and they will tell you not only about their own insurance problems, but their friends’, their neighbors’, people they go to church with, people they play golf with. It's a big topic in these communities.

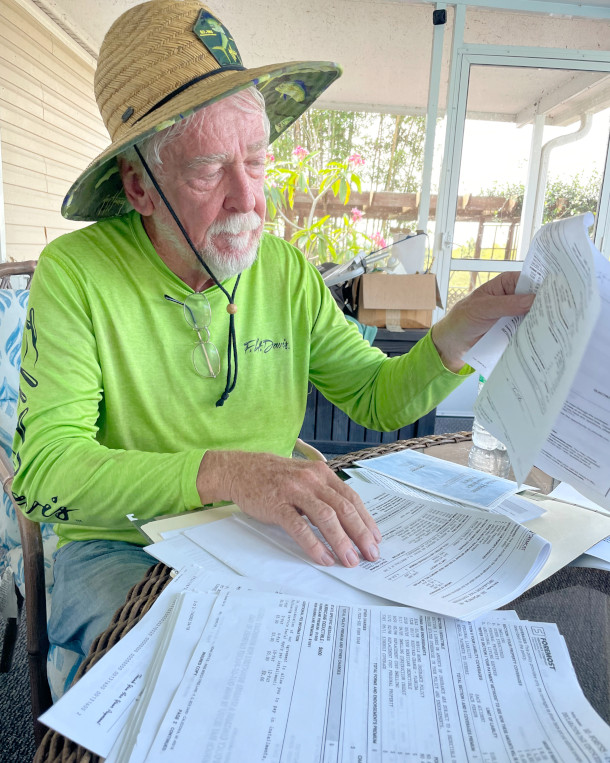

Homeowner Doc Thrift received an insurance renewal notice totaling $14,500, so he instead decided to take out a personal loan to pay off his mortgage and go without insurance. (Photo: Amy Green, Inside Climate News)

CURWOOD: And Amy, by the way, how much of this non-renewal rate, these high rates, appear to be connected to the climate crisis?

GREEN: The problem is very connected with climate change. And there has been academic research into the fact that insurance companies are increasingly passing the costs associated with climate risk on to homeowners, and that's certainly what we're seeing here in Florida. State efforts to help these homeowners really have fallen short, and that has left homeowners to bear this economic burden, really, by themselves.

CURWOOD: Well, now, there's a state-backed insurance company there. How does that state-backed insurance program factor into all of this?

GREEN: Yes, we have a state backed insurer called Citizens, and that provides insurance for people who are unable to get insurance through the private market. Citizens, the number of policies has grown to the point where that has become a considerable concern, because if we were to have a major disaster, there are concerns that citizens would have a hard time paying the costs of that disaster. Our analysis did examine that issue. We were told Citizens can never go broke, that Citizens is able to impose surcharges on premiums paid by Florida homeowners, including not just its own customers, and that Citizens had already done that in the past after severe hurricane seasons in 2004 and 2005 and that Citizens was able to recover the money it paid out over the following decade. But that has become a concern. So there's been an effort to depopulate Citizens and move Citizens customers back into the private insurance market.

CURWOOD: Now I want to go to the mortgage question here. Almost all mortgages require the mortgagee to have an insurance policy. How are people responding to this squeeze? One of the people you just talked about spending like 1,200 bucks a month for home insurance, I suspect that might be more than their mortgage payment if they have a simple house. How are they coping?

Floridian Steve Cates saw his annual insurance rate jump 180 percent in the past six years, ultimately reaching $4,742 before recently being cancelled by the insurance company. Cates had originally planned to leave his home to his son but is reconsidering due to the insurance crisis. (Photo: Amy Green, Inside Climate News)

GREEN: Yes, a lot of other people who I talked to, if they were able to pay off the mortgage, they were going without. One homeowner I talked to, he was retired. He was planning to leave the house to his son, who lived in another state, but he was concerned about how the insurance situation might affect the value of the property, and he was concerned about whether leaving the house to his son might be leaving the son with a burden. One homeowner I talked to took out a personal loan so that he could use the personal loan to pay off his mortgage, so that he could go without insurance. And this, again, is another concern, because then you have a disadvantaged community where a large percentage of people have no insurance, and that is a concern if they were to have another disaster in the future.

CURWOOD: Yeah, let's talk about the population trends now then, in the face of this insurance crisis related to the climate, what has the impact been on Florida's population? I mean, are people still moving there in numbers, or more people moving out? What's going on?

GREEN: Yes, people are still continuing to move to Florida. The real estate market remains very strong. Florida is just a place where people want to live, even on the coasts, in the more affluent, desirable areas, it continues to be a popular place for people to come.

CURWOOD: Okay, I know you're a journalist, you're not a social psychologist, but what the heck is going on? We're told economic theory says that if prices rise, consumers make other choices. So if it costs an awful lot to insure there, and it's cheaper elsewhere, and it's, in fact, unaffordable for some people, especially lower income people, they should go where their pocketbooks are telling them. But doesn't sound like they are.

GREEN: Yes, the insurance situation definitely is making housing harder to afford in the state of Florida. It's definitely increasing the cost of housing in the state of Florida. Florida is just a place where people want to live, and the coast, it's a beautiful place, and so people who have the means are willing to take on that risk. I would also add too that people have short memories and people receive mixed messages from our leaders when it comes to climate risk. It can be hard to understand what the climate risk actually is.

Amy Green is a reporter with our media partner, Inside Climate News. She lives in Orlando, Florida. (Photo: Courtesy of Amy Green)

CURWOOD: Well, just let me say, as a state, Florida has a rather interesting relationship with the realities of climate disruption. I mean, the state is famous for intense storms, what three major ones this last year alone, right? But the state government, under Republican Governor Ron DeSantis is really doing its best to not just ignore but outright deny climate change. With that context, what do you make of this insurance crisis on the state level?

GREEN: I think that it leaves homeowners on our own when it comes to this insurance problem, I think that state efforts to help homeowners have really fallen short. There was legislation a few years ago. There is a state program called the My Safe Florida program that offers money to help homeowners fortify our homes, like put a new roof on and put new windows in and that will help protect homes from damage during disasters, and it also can help lower insurance rates. The money really is not enough to meet demand, and efforts to expand that program have not been successful. Our Governor Ron DeSantis, who is Republican, he also has initiated a program called Resilient Florida that offers money to communities to help fortify infrastructure against hurricanes and floods, and that has been a good program, and that has helped a lot of communities. But DeSantis and our other state leaders have really done next to nothing when it comes to addressing the cause of climate change, which is greenhouse gas emissions. And as a matter of fact, a few years ago, DeSantis signed separate legislation that removed instances of the words climate change from our state code when it comes to our energy policy. So you're right, our state government really has kind of taken a stance of denial to a degree when it comes to climate change, and I think that leaves homeowners kind of on our own when it comes to this insurance problem.

CURWOOD: Amy Green is a reporter with our media partner Inside Climate News, based in Orlando, Florida. Thanks so much for taking the time with us today.

GREEN: It's a pleasure to talk with you. It's a great show.

Links

Inside Climate News | “In the Midst of Florida’s Insurance Crisis, What Recourse Do Residents Have?”

Living on Earth wants to hear from you!

Living on Earth

62 Calef Highway, Suite 212

Lee, NH 03861

Telephone: 617-287-4121

E-mail: comments@loe.org

Newsletter [Click here]

Donate to Living on Earth!

Living on Earth is an independent media program and relies entirely on contributions from listeners and institutions supporting public service. Please donate now to preserve an independent environmental voice.

NewsletterLiving on Earth offers a weekly delivery of the show's rundown to your mailbox. Sign up for our newsletter today!

Sailors For The Sea: Be the change you want to sea.

Sailors For The Sea: Be the change you want to sea.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth