Tar fields along the Athabasca River in Alberta, Canada. (Photo: National Geographic Magazine, June 2004) Tar fields along the Athabasca River in Alberta, Canada. (Photo: National Geographic Magazine, June 2004)

CURWOOD: Let’s talk a bit about oil recovery technologies. Now, you grew up in the oil fields there of east Texas. They used to just, what, put a drill in the ground and go, right?

ALLEN: That’s exactly it. And then some things came on called “secondary recovery,” at which you could inject either water or gas into the ground and drive that oil out of the oil shale, or the oil sands, up into the pipes for recovery. And that has really increased greatly the recovery and the amount of oil you can recover from each field. And now the Russians have begun using this kind of technique in their areas, and it has really increased their production quite dramatically. As a matter of fact, they just surpassed Saudi Arabia as the world’s largest oil producer. And that’s primarily because of the secondary techniques. They’re now beginning to drill for oil and to recover oil in the same way that the United States has been doing for a long time.

CURWOOD: So, what’s the true cost, then, of these emerging oil technologies in terms of, well, the environment, as well as the political and social impacts?

Tar oozes from sand along the Athabasca River. Formed millions of years ago as oil leaked from reservoirs, the tar, or bitumen, permeates more than 15,000 square miles. (Photo: National Geographic Magazine, June 2004) Tar oozes from sand along the Athabasca River. Formed millions of years ago as oil leaked from reservoirs, the tar, or bitumen, permeates more than 15,000 square miles. (Photo: National Geographic Magazine, June 2004)

ALLEN: Well Steve there are things that are really the hidden costs of oil. And using gasoline, for example, some are even more subtle than others. If you adjus the cost of the oil itself, about 50 percent of the cost of a gallon of gasoline in this country comes from the crude oil cost itself. But then you have other costs, such as refining, and distribution, and the profit to the oil companies, etc. And then you have taxes. Now, in this country we pay probably less tax than almost anyone else in the world on oil. If you look at Germany or England or some of the other European countries, you end up with $3 or $4 per gallon in taxes.

But there are other hidden costs, such as the cost of sitting in traffic and burning fuel that is not being used to push someone somewhere, but is just being burned while you’re sitting at stoplights or in gridlock someplace. And the cost of accidents. But there’s an even more hidden cost than that, and it’s one that’s almost impossible to measure: what is the cost of securing oil fields around the world? This is in terms of military presence, of security presences, around the world, whether it’s in the oil fields themselves or in the shipping lanes to protect that.

Right now there’s a big worry in the Malacca Straits around Indonesia as to what’s going to happen if Al-Qaeda should suddenly launch an attack there. You have a very narrow choke point about a mile across. If a big tanker or something is sunk there, then you’re going to have to have a bit of a diversion in an additional thousand miles in your trip to get oil especially to Japan, for example. So these are all really, really hidden costs and there’s almost no way to put a cost, a price on that.

CURWOOD: Let’s make a try at looking at these hidden costs. What do you estimate it costs us in terms of, say accidents?

ALLEN: I would guess probably about $1 a gallon to sit there and burn oil while you’re sitting in a traffic jam, and about another 80 cents for traffic accidents and stuff. So by the time you add all of these things together you’re looking at a price somewhat over $4 a gallon, is the actual cost of the oil that you’re burning in your car now.

CURWOOD: What kind of stab could you make at the defense costs? I mean, what’s sort of the minimum amount that we could attribute to our military presences required to maintain oil security at this point?

ALLEN: That’s an even more difficult number to come up with. It would just be a wild guess for anyone to come up with what percentage of our military budget is devoted to that. But I would think it has to be at least another dollar or $2 per gallon.

CURWOOD: So at the end of the day, oil, gasoline for cars, is costing everybody about $6 a gallon?

ALLEN: That would probably be about right, six, maybe even $7 a gallon, Steve.

CURWOOD: We don’t pay that at the pump, of course, because it comes from things like the defense budget, or people’s health insurance for taking care of accidents, or companies really losing their productivity of employees stuck in traffic.

ALLEN: That’s exactly it. And that’s why those are such hidden costs, and why it’s so hard to narrow those things down. But they are indeed real costs of oil.

CURWOOD: So, Bill, how do you get that number into the public discussion about the way we use energy, the way we use oil?

ALLEN: Well, Steve, I think one of the best ways is to do exactly what you’re doing right now. Get it out there and make people know what the true cost is. And then maybe they will be able to figure out that, hey, this is an extraordinarily valuable commodity. Maybe we should concentrate a little bit more on that one-third of our oil supply that is not being burned but is used to produce fertilizers, for pesticides, for plastics for your soccer balls and bike helmets, cell phones. That kind of thing may be an even better use for the oil that we have now.

CURWOOD: I want to ask you more about that, but we need to take a break right now. My guest is Bill Allen, editor-in-chief of National Geographic magazine. In just a minute we’ll continue our discussion with Bill Allen, and then talk with the chief economist from the American Petroleum Institute. Stay tuned to Living on Earth.

[MUSIC]

CURWOOD: Welcome back to Living on Earth, I’m Steve Curwood. If you’re just tuning in, my guest is Bill Allen, editor-in-chief of the National Geographic magazine. This month’s cover story is called “The End of Cheap Oil.”

Bill, before the break, you were telling us how oil is used for more than just gassing up our cars. While two-thirds of it is used for transportation here in the U.S., you said the remaining third goes for a wide variety of other purposes. Now what are some of these other uses of oil?

ALLEN: Well, let’s see, if you have some kind of carpeting in your home, that’s probably, unless it’s cotton or wool, is probably going to be derived from oil products. Almost anything that’s plastic, a lot of parts of televisions, cell phones, a lot of these things are derived from oil. It takes about three-quarters of a gallon of gasoline to produce a pound of steak. It takes about seven gallons of oil to produce a tire. So there’s a lot of things that we don’t really think about that are directly related to the rest our lives.

We have a lot of things that are produced, and as a matter of fact, some people have said perhaps it is that oil is too valuable to burn. It’s much more useful for all of these other, for the entire plastics industry, for all of this. The cost of our food, for example. The reason that corn costs, is relatively inexpensive, is probably because of relatively inexpensive oil.

CURWOOD: Oil that’s used as fertilizer.

ALLEN: Oil that’s used as fertilizer. That’s another huge use in our agricultural area that people don’t really think about. Pesticides, those are also derived. If we didn’t have pesticides or fertilizers derived from oil products, our cost of food would increase dramatically and would have a direct effect on all of us. I presume that everybody likes to eat.

CURWOOD: (laughs) guilty as charged. If oil gets more expensive, it would seem that alternatives would swing into place, that that very high price would change people’s behavior like in the old embargo, say from the 70s, people started building and buying much smaller cars.

ALLEN: Steve, you’re right. We have seen that actually happen, back in 1983, we saw about a 15 percent drop in US domestic oil consumption when the oil prices did go up to about $70 a barrel, and we saw people demand more fuel-efficient cars. So that kind of thing in all probability would happen. Also you see the same kind of thing from taxes. In Germany for example, where a lot of the cost is maybe $3-$4 in that range of the cost of a gallon of oil, gallon of gasoline rather, is by taxes.

You do see a demand for more fuel-efficient cars. So that kind of thing could delay the time at which we have to switch to an alternative. And it takes a lot time, Steve, to find these new technologies that are going to replace oil. We’re talking 20,30,40, some even say 50 years to find new technologies that would be able to replace oil. And every day that we can buy by conserving gives us a little bit more time to develop those technologies.

CURWOOD: What do you think the world is going to look like when this oil crunch comes?

ALLEN: Well I think there’s going to be a lot of shock. You know, in this country especially, we’re not very good at planning ahead many times. We sort of wait for other people to force the action, and then we react. Americans have a great way of reacting very quickly to problems, but we don’t have the same kind of great track record for anticipating problems. So I would think that as the time gets closer and the oil prices begin to creep up, there’s going to be a slow realization that we really do have to conserve. And we have to find other ways to use more fuel-efficient cars, for example, since we do use about two-thirds of this for our fuel.

CURWOOD: So Bill, what’s being done then to guard against the day when oil is no longer cheap? I mean, what changes should we be making that we’re not right now?

ALLEN: Well, one of the things we really can do that’s almost pain-free, is to demand and look for more fuel-efficient cars. This is the kind of thing that doesn’t really take a lot of sacrifice on everyone’s part, and you can continue using those cars. That’s probably the biggest single thing we can do. Obviously conserving energy in all forms is going to be another way.

CURWOOD: Now one question about burning oil: With all the concern about climate change, how long do you think we’ll be able to keep burning oil the way we’ve been burning it?

ALLEN: Well, there’s no indication that there’s a great deal of incentive to stop burning it. So I think we’ll probably continue to burn it until the price gets too expensive. And that’s when we’re talking about cheap oil. As long as it is so cheap that we can almost use it as a disposable commodity, we will probably continue to use it as a disposable commodity.

CURWOOD: How do you get people to change their approach to this, the political system to change its approach to this?

ALLEN: Well, it’s very difficult, you know, it’s going to be political suicide for anyone to say, you know what we really need in this country is about $3 a gallon tax. I can’t even imagine a President supporting that, or the majority of the House or Senate, or the Senate doing anything like that. So it’s going to be very difficult to attack it from that point of view. And what’s going to happen, as these prices go up, and as we see what the effect is of this increased oil price, we’re going to give away to other countries and to other petroleum suppliers the ability that we have to control our own destiny.

We could control by finding some way to encourage further conservation in this country and more gas mileage in cars, for example, but it’s going to be very difficult to do. It’s going to take a lot of political will, and it’s going to take a lot of explaining by a lot of politicians, and it’s going to take a lot of courage by politicians to say, you know, we have a serious problem that we’re going to be facing here. And until we can develop new technologies for this, we have to make sure that we’re going to have the oil to get us through that bridge time. It may be that there has to be some other drastic, drastic step that is taken, but what’s going to happen is that drastic step is probably going to have to be taken outside of our political system. Because we might react very well to that, but I don’t think we’re going to be pro-active.

CURWOOD: You say it would take drastic action. What do you mean by that?

ALLEN: If there is another bump in oil prices, if there is a huge political change in some country that has control over a significant part of the supply in the world, and you see oil suddenly double or triple in price, that’s drastic action. At that point, there’s going to be an enormous gas line down the street. There’s going to be an enormous increase in the cost of food, in all the things we use oil for. Plastics, anything that has plastic would go up, if you see that price spike in petroleum products. So it’s that kind of thing that would then be outside the control of the United States that we would have to react to.

We have the ability to try and change standards in automobiles, to even consider the possibility of reducing oil consumption in some way. But if we don’t do it and someone else does, then that’s the kind of shock that everyone is going to see, and recognize, man, we have really been hit right between the eyes on this.

CURWOOD: Bill Allen is editor-in-chief of the National Geographic magazine. Bill, thanks for taking this time with me today.

ALLEN: Thank you very much Steve, I enjoyed it.

CURWOOD: To get a different perspective, I’d like to turn to John Felmy. He’s chief economist and director of policy analysis and statistics for the American Petroleum Institute. John, welcome to Living on Earth.

FELMY: Thank you for having me.

CURWOOD: Now I gotta ask you this. We hear from folks who say the days of cheap oil are coming to an end, that oil production could peak sometime soon, say by 2016 and gradually head down from there. How accurate do you think these predictions are?

FELMY: I don’t think they’re at all accurate. Folks have been arguing that we’re gonna run out of oil very soon for the last 100 years. But unfortunately the facts don’t prove them correct. Each year we tend to find more oil than what we consume, so we build our reserves. And as long as that happens, the end is not in sight.

CURWOOD: So from your research, what would you say is the worst case scenario for the global oil supply that you consider in your long range planning? I mean, at what point is there gonna be tightness in the supply? Is it five years, ten years, twenty, fifty, 100, 200, at what point does your research say, well, we should be concerned?

FELMY: First of all we’re never going to run out of oil, it’s a question of the price and the tightness as you indicated. It’s clear that there are abundant resources, we’ve got a trillion, maybe 1.2 trillion barrels of oil that we know about, and there’s probably twice that that we haven’t simply found. The question is, will we be able to go about and get it? Will we be able to explore for the oil and will we be able to develop the resources that are the most promising?

CURWOOD: Ok, and the answer is?

FELMY: The real concern I have is for the restrictions to be placed on the industry and not allow us to do that. And then it could be short-term in terms of supply impact. So it’s really the political framework that I can see as a restriction on supply.

CURWOOD: What would those constraints be, John?

FELMY: Basically preventing us from developing resources where we know they are. Alaska’s an excellent example where we can produce 10 billion barrels of oil, but we can’t explore and produce it there. The outer continental shelves of both the West and East coast are another example, some Rocky Mountain areas. And then internationally there’s of course the politics of various countries that may prevent that kind of exploration. So it’s more of not being able to develop it that’s a big concern that I have.

CURWOOD: John, at some point in the years ahead, the economy’s gonna make a change in how it consumes energy, whether it’s over the near term or further out. At what point do you see economies making a shift away from burning oil?

FELMY: It’s likely not to change within our lifetimes. If you look at what share oil comprises of our consumption, it’s roughly 40 percent. There are very few other alternatives to oil, especially for transportation, that we can see. Developments such as hydrogen and other alternatives, whether they be electric vehicles or things like that are much further down the pike than we can see at this point. There are some promising alternatives that can be developed such as methane hydrates, which is natural gas frozen in ice crystals, which could perhaps play an important role say in the latter part of this century. But in the short run, the role of oil, coal, gas, nuclear, and hydro are likely going to be the same, and those are our conventional energy sources.

In Texas, a crew plugs a well abandoned by the owner when its flow slackened to a trickle. (Photo: National Geographic Magazine, June 2004) In Texas, a crew plugs a well abandoned by the owner when its flow slackened to a trickle. (Photo: National Geographic Magazine, June 2004)

CURWOOD: Now people say that if you were to take today’s dollars, that the last peak of oil back in the late 70s, early 80s, was about the equivalent of $70 a barrel. How close to accurate is that for you?

FELMY: When if you adjust for inflation, you’ll find that the price of a barrel of crude oil in 1981 was about $72 a barrel, and gasoline prices were almost $3 a gallon when you adjust for inflation.

CURWOOD: So from that analysis you would say that we have a long ways to go in the present price run-up before we feel the discomfort of the 1970s, 1980s?

FELMY: Well, it’s clear we’ve already begun to feel some of the discomfort, because of course, higher oil prices mean lower incomes, lower purchasing power, a drag on the economy. But we’re far from the peak of oil prices that we experienced in the early 1980s.

CURWOOD: What would it do to the economy if we got back to those early 80s oil prices, if oil in fact was $70 a barrel?

FELMY: If we went from the current price which is slightly less than $40 a barrel, to over $70 a barrel, many economists would argue that it would likely push the economy into recession.

CURWOOD: And what are the odds of that happening at this point, do you think?

FELMY: At this point it’s very difficult to tell. It’s going to depend on first of all OPEC behavior, how well things turn out in Iraq, Venezuela, Nigeria. And then on the demand side, will the Chinese economy continue to grow at the very fast rate that it has been growing, and will other economies continue to grow, such as India. And each of these economies has increased their demand for petroleum dramatically, and has had a real impact on the world marketplace for crude oil.

CURWOOD: So maybe the question is not whether, but when we will see $70 a barrel oil.

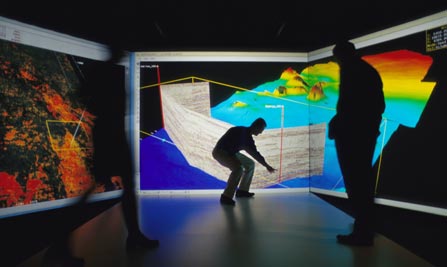

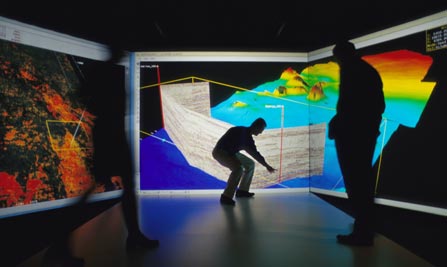

FELMY: Well, then you have to get back to the supply side. As we’ve seen, technology in the oil industry has continued to dramatically improve. We have been able to find oil much more easily than we have in the past at much lower cost. We’ve been able to produce oil in thousands of feet of water. We’ve been able to produce oil in extremely hostile environments, and we’ve been able to find it such that you can find a deposit of oil five miles away using the seismic technology that we have. So as long as the technology continues to develop at the pace it has been, then what it means is you’re able to bring more and more oil on stream more cheaply.

Like a surgeon’s CT scan, a three-dimensional seismic image reveals rock formations that may hold oil. (Photo: National Geographic Magazine, June 2004) Like a surgeon’s CT scan, a three-dimensional seismic image reveals rock formations that may hold oil. (Photo: National Geographic Magazine, June 2004)

CURWOOD: Now how do these new oil recovery technologies compare with the traditional of drilling the industry was built on? Particularly cost-wise?

FELMY: They’ve brought the cost of finding and producing oil down dramatically. We’ve seen over even in the last 20 years a dramatic fall in what we call finding costs of oil, so that we’re able to find it and produce it for far less than we did even a short period of time ago. It’s really a wonderful example of how American industry has responded to the challenge.

CURWOOD: At what point do you think that oil will be a smaller part of the energy mix than it is today?

FELMY: I don’t see oil taking up a smaller part of the energy mix until the latter half of the century.

CURWOOD: Ok, well this is helpful, so the latter part of this century, so we’re looking at maybe 2050 or so, in the second half of the century, that we’ll see this gradual shift away from oil?

FELMY: Well, it’s hard to even say at that point. I think the latter half of the century, I would think more of as the last quarter of the century. So maybe I’m using improper English, which is typical of a central Pennsylvanian, but I see that we’ll continue to develop more resources, natural gas will continue to grow in share, primarily in electricity generation. But it’s going to be very, very difficult to shift off of oil for transportation, until we see some fundamental breakthroughs in the technologies involved.

CURWOOD: John Felmy is chief economist and director of policy analysis and statistics for the American Petroleum Institute in Washington. John, thanks for taking this time with me today.

FELMY: Thank you very much, Steve, thanks for having me.

Living on Earth wants to hear from you!

Living on Earth

62 Calef Highway, Suite 212

Lee, NH 03861

Telephone: 617-287-4121

E-mail: comments@loe.org

Donate to Living on Earth!

Living on Earth is an independent media program and relies entirely on contributions from listeners and institutions supporting public service. Please donate now to preserve an independent environmental voice.

NewsletterLiving on Earth offers a weekly delivery of the show's rundown to your mailbox. Sign up for our newsletter today!

Sailors For The Sea: Be the change you want to sea. Sailors For The Sea: Be the change you want to sea.

The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment. The Grantham Foundation for the Protection of the Environment: Committed to protecting and improving the health of the global environment.

Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs. Contribute to Living on Earth and receive, as our gift to you, an archival print of one of Mark Seth Lender's extraordinary wildlife photographs. Follow the link to see Mark's current collection of photographs.

Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth Buy a signed copy of Mark Seth Lender's book Smeagull the Seagull & support Living on Earth

| | |

Discovered in 1911, California’s South Belridge field has produced more than a billion barrels of oil. Tapped by 10,200 wells, it may have several decades of life left – but with a declining output. (Photo: National Geographic Magazine, June 2004)

Discovered in 1911, California’s South Belridge field has produced more than a billion barrels of oil. Tapped by 10,200 wells, it may have several decades of life left – but with a declining output. (Photo: National Geographic Magazine, June 2004)  Tar fields along the Athabasca River in Alberta, Canada. (Photo: National Geographic Magazine, June 2004)

Tar fields along the Athabasca River in Alberta, Canada. (Photo: National Geographic Magazine, June 2004)  Tar oozes from sand along the Athabasca River. Formed millions of years ago as oil leaked from reservoirs, the tar, or bitumen, permeates more than 15,000 square miles. (Photo: National Geographic Magazine, June 2004)

Tar oozes from sand along the Athabasca River. Formed millions of years ago as oil leaked from reservoirs, the tar, or bitumen, permeates more than 15,000 square miles. (Photo: National Geographic Magazine, June 2004)  In Texas, a crew plugs a well abandoned by the owner when its flow slackened to a trickle. (Photo: National Geographic Magazine, June 2004)

In Texas, a crew plugs a well abandoned by the owner when its flow slackened to a trickle. (Photo: National Geographic Magazine, June 2004)  Like a surgeon’s CT scan, a three-dimensional seismic image reveals rock formations that may hold oil. (Photo: National Geographic Magazine, June 2004)

Like a surgeon’s CT scan, a three-dimensional seismic image reveals rock formations that may hold oil. (Photo: National Geographic Magazine, June 2004)